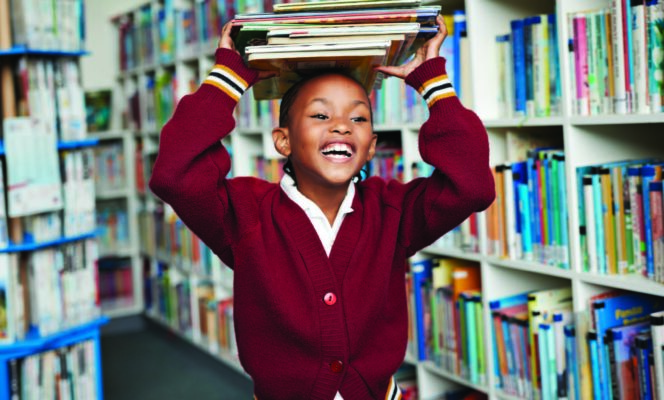

LIBRARY LOVERS’ MONTH IS HERE!

Share the love. Supporting libraries helps communities thrive.

As Walter Cronkite said in 1995, “Whatever the cost of our libraries, the price is cheap compared to that of an ignorant nation.” The late CBS News anchor is just one of countless library lovers—past and present—who have publicly credited libraries for the important contributions they’ve made to communities, countries, and the world.

Those who love libraries and the access they provide to books, magazines, music, research, databases, and more can show their love year-round, but Library Lovers’ Month in February creates a perfect opportunity to highlight libraries, their contributions—and how we can give back. February also has the added bonus of Library Lovers’ Day on February 14, Valentine’s Day.

Ways to show your support

Many libraries have special events or promotions during Library Lovers’ Month to inform and entertain their visitors, create stronger bonds with their communities, and promote ways to support library programs and resources. Some ideas include:

Consider making a tax-deductible gift to your library.

Volunteer your time and/or expertise.

Donate used books.

Promote, support, and advocate for your library in your community.

The benefits libraries bring to users and communities

Shelves of countless books are what most people associate with libraries, but libraries provide access to information and learning through multiple mediums—including databases users can’t access from home without a library account. Most public libraries offer remote and in-person events to introduce new ideas and information, promote literacy, teach skills, help create communities, and answer questions. Most of them also provide access to computers and the internet, benefitting those who don’t have those options at home.

They also help the local economy. According to the American Library Association, 76% of public libraries help patrons with job applications and job-interview skills, and 48% of them provide information and assistance to entrepreneurs who want to start their own business.

Another often-overlooked resource is librarians. As author Neil Gaiman said, “Google can bring you back 100,000 answers. A librarian can bring you back the right one.”

Pandemic challenges libraries have faced.

Public libraries have faced ongoing challenges during COVID-19, but their resilience and desire to support their communities has remained strong. The ALA reported in April 2021 that libraries worked to adapt to a new way of doing business—even as they were forced to close their doors. “Closures did not prevent library workers and libraries from serving their communities. Instead, closed physical space fueled significant innovation and opportunities to assist and support patrons and students,” the ALA said.

They’ve continued to adapt as they opened up again, following and enforcing mask mandates and other requirements. In January 2022, The Washington Post wrote about public libraries becoming coronavirus test distribution sites, making librarians the pandemic’s latest front-line workers.

The history behind Library Lovers’ Month

It’s not clear who started Library Lovers’ Month—or when—and multiple Google searches failed to answer the question. Asking a librarian might have been a better choice.

We know this, though: Library lovers have been around for thousands of years. The first known library was established in 700 BCE, in what is now Iraq. Although library resources have changed substantially since then, library goals over the last 2,700 have stayed the same: to collect knowledge, learn from it, make it available to others, and use it to make life better. That’s what they do—and that’s why there are so many library lovers ready to recognize and celebrate Library Lovers’ Month every February.

Thanks for checking out the blog.

Gregory Armstrong , CFP®

This material is for general information only and is not intended to provide specific advice or recommendations for any

individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive

outcomes. Investing involves risks including possible loss of principal.

This material was prepared by LPL Financial. Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and

broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL Financial affiliate, please note LPL Financial makes no representation with respect to such entity.

Securities and insurance offered through LPL or its affiliates are: