Free Money!

For Marylanders Saving For Education.

Certain TV commercials have stuck with me over the years. In the 90s there was a goofy guy, Matthew Lesko, dressed in brightly colored suits polka-dotted with question marks promoting his Free Money series of books. Maybe you remember these. Even if you don’t, I want to share with you a Maryland program that offers free money for the beneficiaries of the Maryland College Investment Plan Account AKA the Maryland 529 Plan.

I like referring to it as the Maryland 529 plan because it is not just for college savings. It can also be used to save for trade school and private k-12 education. The plan is an investment account where growth is not subject to federal or state tax if used for qualified education expenses. Maryland taxpayers can also receive a Maryland state tax deduction of up to $2,500 per contributor, per beneficiary.

In addition to the contributions that you and your friends and family make to the plan, you may also be eligible for contributions of $250 or $500 from the state of Maryland through the Save4College State Contribution Program. Before you even read more about it, log on to your Maryland 529 plan account and complete the application. It will take less time to complete and will make sure you meet the deadline by 11:59 PM on May 31, 2022.

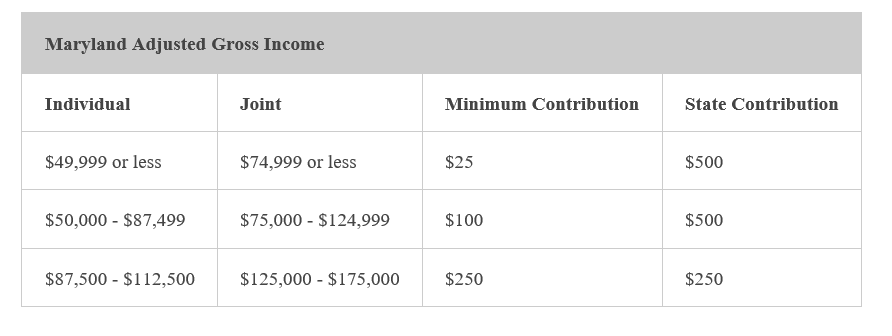

The amount of contribution that you are eligible to receive and the minimum contribution that you are required to make depends on your Maryland Adjusted Gross Income the previous year. Here is a chart table taken directly from www.maryland529.com.

Assuming you meet the income requirements here are the other eligibility requirements and some insights.

- The account owner and beneficiary must both be Maryland residents. Starting this year, the beneficiary must be under the age of 26 in the calendar year before the account holder submits an application.

- The Maryland 529 account must have been opened after December 31, 2016. If you began saving before this date, your spouse or grandparents could open a new account that would qualify. Or, you could open a new account with a different beneficiary, then change the beneficiary later on.

- Only one application per account holder/beneficiary relationship can be submitted, but beneficiaries can receive up to two state contributions per year. This is an interesting opportunity for retired grandparents or other relatives who could potentially be eligible for the state contribution where working parents are not, or for lower-income relatives who might qualify for a higher benefit.

- There is also a lifetime limit of $9,000 of state contributions per beneficiary. If you have received $9,000 in benefits already, that’s awesome, but you will not qualify for additional contributions.

Action Items

- Sign up for a Maryland 529 at www.maryland529.com if you have not already.

- Complete the Save4College application by 11:59 PM on May 31, 2022

- Make the required minimum contribution by November 1, 2022

- Receive your state contribution by December 31, 2022

It is important to note that the Save4College program is subject to changes by the Maryland General Assembly and funding. There is no certainty that you will receive a state contribution if you complete the application.

It is also important to note that this has been written for educational purposes only and is not meant to be financial advice. You should consult with your advisor to see how this pertains to your specific financial situation.

Thanks for checking out the blog.

Schuyler Engelhardt , CFP®

This material is for general information only and is not intended to provide specific advice or recommendations for any

individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive

outcomes. Investing involves risks including possible loss of principal. Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and

broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL Financial affiliate, please note LPL Financial makes no representation with respect to such entity.

Securities and insurance offered through LPL or its affiliates are: